Multi Peril Crop Insurance for Beginners

Table of Contents3 Easy Facts About Multi Peril Crop Insurance ExplainedThings about Multi Peril Crop InsuranceMulti Peril Crop Insurance Things To Know Before You Get ThisThe Definitive Guide to Multi Peril Crop InsuranceNot known Facts About Multi Peril Crop Insurance

The plant insurance coverage under FCIP are recognized are multiple-peril farming insurance coverage and also are based upon yield or profits. Not all crops are guaranteed by these policies. While the federal-government problems see regarding the crops to be insured for every various other, one of the most generally guaranteed plants include corn, cotton, soybeans, and wheat while several other crops may be guaranteed where they are located a lot more commonly.

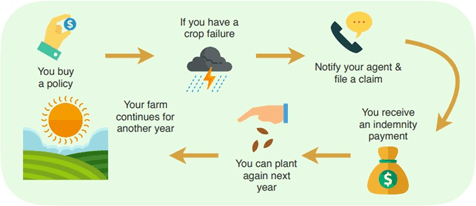

It is by comparison with this referral and by using the government market price of the crops that asserts can be made as well as insurance coverage is dispersed. It is worth bearing in mind that farmers ought to purchase multiple-peril insurance coverage before growing the crops before the deadline or the sales closing date (SCD).

The Basic Principles Of Multi Peril Crop Insurance

Different from the FCIP Insurance policy plans, Plant hail insurance coverage is not connected with the federal government and also is entirely marketed by exclusive business that can be purchased any type of time during the crop cycle. Hailstorm protection, unlike the name suggests, covers plants from threats aside from hail storm like fire, lightning, wind, criminal damage, and so on.

When getting in right into the contract with the insurers, farmers choose the volume of the yield to be insured (which could be between (50-85)% depending upon demands) in addition to the defense rates of the federal government. While MPCI makes use of the referral return gotten from the historic information of the farmers to identify the loss, Group-Risk-Plan (GRP) makes use of a region return index.

Because these computations can require time, the moment of settlement upon cases can take more time than MPCI repayments. Income Insurance coverage policies, on the various other hand, offer protection against a decrement in produced income which may be a result of loss of manufacturing as well as the modification in the marketplace price of the crops, or perhaps both.

The Only Guide for Multi Peril Crop Insurance

This type of plan is based upon offering defense if as well as when the ordinary region income under insurance policy goes down below the income that is chosen by the grower. Plant insurance policies are essential to the monetary sustainability of any type of farmland. Although the fundamental idea of agriculture insurance is as basic as it is needed to understand, choosing the very best kind of insurance policy that matches your certain needs from a variety of insurance coverage can be a challenging job.

Nonetheless, it is essential to keep in mind that insurance coverage for dry spell might have specific restrictions or needs. The plan could have particular standards relating to the seriousness and also period of the drought, as well as the impact on plant manufacturing. Farmers should meticulously assess their insurance plan as well as talk to their insurance representative to understand the extent of protection for drought and also any kind of various other weather-related risks.

Mark the broken field areas after a weather condition calamity or a disease or an insect assault as well as send out reports to the insurance policy.

The 5-Second Trick For Multi Peril Crop Insurance

For a thorough summary of exact insurance coverages, restrictions as well as exclusions, please describe the plan.

As well as there's some various other points that should consider things like the farm equipment and the tools, exactly how much coverage you require for that? One of the things that I believe about a great deal is your cars.

The Buzz on Multi Peril Crop Insurance

Or if you do move it to a farm automobile policy, normally on a ranch vehicle policy, your liability will certainly start higher. Among the reasons we consider that too, and also why we create the greater restrictions is since you're not only utilizing that car or you may not simply have that automobile individually, yet if you are a farmer and also that is your livelihood, having something that can come back to you, that you are accountable for, having those higher limitations Go Here will certainly not only shield you as as a private, yet will certainly help safeguard that farm as well.

That can go on the homeowner's plan. Yet when your ranch equipment is used for even more browse around here than simply maintaining your home, after that you truly do intend to add that type of machinery to a ranch policy or you wish to seek to obtaining a farm plan. I have farmers that guarantee points from tractors to the watering equipment, hay rakes, incorporate, so lots of different points that can be covered separately.